Beneficial owners in Norwegian registered foreign businesses (NUF)

Last updated: 24 October 2024.

Check if your business must register beneficial owners:

An NUF doing business activity in Norway is obliged to report whether or not it has beneficial owners.

Worth knowing prior to the registration:

If the foreign main company is domiciled in an EEA country, and has its beneficial owners registered in an equivalent register there, it is sufficient to confirm this in the form.

A beneficial owner is a Norwegian or foreign person who meets one or more of these criteria:

-

owns more than 25 percent of the business

-

controls more than 25 percent of the voting rights in the business

-

has the right to appoint or remove more than half of the board members in the business

Example: In accordance with the agreement/articles of association, certain share classes may provide the right to elect a given number of the company’s board members

-

influence/control in another way

Example: Rights to decide or veto, or situations where the person’s recommendation is followed consistently by the majority shareholders or owners

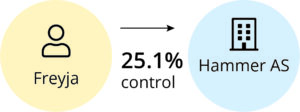

You are a beneficial owner based on direct ownership or control or indirect ownership or control.

When there is no business between the person and the business subject to registration, the person is a beneficial owner on a direct basis.

Example:

A person who controls a sufficient share of a business who in turn has sufficient control of the business obliged to register beneficial owners.

To be a beneficial owner, a person must indirectly control more than 25 percent at the first level, then control 50 percent or more at subsequent levels.

At the first level, the following rules apply:

- ownership more than 25 percent

- voting rights more than 25 percent

- the right to appoint or remove more than half of the board

- influence/control in another way

At all the other levels below apply:

- voting rights 50 percent or more

- the right to appoint or remove more than half the board

Businesses that are between the business subject to registration and the beneficial owners are called intermediate businesses.

A person can be a beneficial owner on an indirect basis in three different ways:

Most of the beneficial owners will be identified in the business’ documents, such as the memorandum and articles of association, the share register and shareholder agreements. Generally speaking, the information here will be sufficient to identify the beneficial owners.

The board is responsible for keeping information about the beneficial owners of the business.

- full name

- national identity number or d-number

If a beneficial owner does not have a national identity number or d-number, you must state the date of birth - country of residence

- all citizenships

- organisation number – when it is indirect ownership or control

You must indicate whether you are the beneficial owner due to ownership, voting rights or the right to appoint or remove board members, or control/influence in any other way.