Beneficial owners in public limited companies, savings banks and European companies

Last updated: 24 October 2024.

Check if your business must register beneficial owners:

Public limited companies, savings banks and European companies must register whether they have beneficial owners or not.

Worth knowing prior to the registration:

If the organisation is listed on Euronext Oslo Stock Exchange or Euronext Expand it needs to state the following information only:

- the name of the market

- the market’s internet address

- which country the market belongs to

If the organisation is listed on a regulated market in another country with equivalent international standards ensuring sufficient transparency into information about ownership, please send us an e-mail to firmapost@brreg.no.

A beneficial owner is a Norwegian or foreign person who meets one or more of these criteria:

-

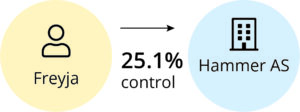

Owns more than 25 percent of the business

-

Controls more than 25 percent of the voting rights in the business

-

Has the right to appoint or remove more than half of the board members in the business

Example: In accordance with the agreement/articles of association, certain share classes may provide the right to elect a given number of the company’s board members

-

Influence/control in another way

Example: Rights to decide or veto, or situations where the person’s recommendation is followed consistently by the majority shareholders or owners

You are a beneficial owner based on direct ownership or control or indirect ownership or control.

When there is no business between the person and the business subject to registration, the person is a beneficial owner on a direct basis.

Example:

A person who controls a sufficient share of a business who in turn has sufficient control of the business obliged to register beneficial owners.

To be a beneficial owner, a person must indirectly control more than 25 percent at the first level, then control 50 percent or more at subsequent levels.

At the first level, the following rules apply:

- ownership more than 25 percent

- voting rights more than 25 percent

- the right to appoint or remove more than half of the board

- influence/control in another way

At all the other levels below apply:

- voting rights 50 percent or more

- the right to appoint or remove more than half the board

Businesses that are between the business subject to registration and the beneficial owners are called intermediate businesses.

A person can be a beneficial owner on an indirect basis in three different ways:

Most of the beneficial owners will be identified in the business’ documents, such as the memorandum of association, the share register and shareholder agreements. Generally speaking, the information here will be sufficient to identify the beneficial owners.

The board is responsible for keeping information about the beneficial owners of the business.

- full name

- national identity number or d-number

If a beneficial owner does not have a national identity number or d-number, you must state the date of birth - country of residence

- all citizenships

- organisation number – when it is indirect ownership or control